By Stuart Lambert, co-founder

At Blurred, we believe that every individual person and every individual company has both the responsibility and the capability to make a difference. To have a positive impact on the world.

The word, capability, is important. We all have agency here. We are passionately optimistic about the role companies can play – will need to play – in solving the challenges we face.

And for four years, we’ve argued that delivering on that responsibility and capability requires that a company deeply integrates ESG and Purpose as a strategy for positive impact. Today, we launch the first tool and methodology for measuring the effectiveness – or not – of that integration.

Firstly, some scene setting.

The terms ‘ESG’ and ‘Purpose’ dominate much of contemporary corporate, investor and brand communication conversations.

These two terms are treated in many quarters as innately separate (as indeed are many of the above conversations). In fact, they are inseparable. One cannot exist properly without the other. Or should not, at least as far as the corporate board room is concerned.

One (ESG) is about mitigating risk to asset value, by ‘doing no significant harm’ to environment and society. The other (Purpose) is about creating value for all stakeholders (vitally, including people and planet as the ultimate beneficiary stakeholders) by ‘doing meaningful good’.

Without Purpose, ESG – no matter how ‘well’ it is done – remains an exercise in compliance. A useful and important accountancy and accountability process in itself, but lacking true direction and motivation. In this mode, ESG reporting may help achieve a basic aim of minimising negative impacts, but the opportunity to deliver positive impact is missed.

And without ESG as a foundation, Purpose is too often misused, particularly by marketers who reduce it to a strapline: a way to look good in front of conscientious consumers. This, ironically, is itself a risk: if ‘purpose’ is used as a convenient label for claiming positive impact on the world, or as a ‘sustainability’ badge for a brand campaign, the risk of greenwashing is significantly increased.

Much comes down to the governance around all this stuff: how it is defined, managed, communicated, reported and measured. How are people held accountable for it? That’s why, of the four ESGP dimensions of integrated board strategy – E, S, G and P – we say the less fashionable ‘G’ is the most important. Because G’ is for the Governance glue that binds everything together.

But ‘G’ is also for the ‘gap’ that exists between ESG and P. And closing the ESGP gap is the vital first step to public companies becoming genuine forces for positive impact in the world.

We now have a methodology for measuring that ESGP Impact Gap. The methodology is based on six months’ partnership with ESG data specialist firm Insig AI, and is grounded in deep understanding of best practice Purpose, as defined by BSI PAS 808, whose technical author, Dr Victoria Hurth, is a Blurred Cohort member.

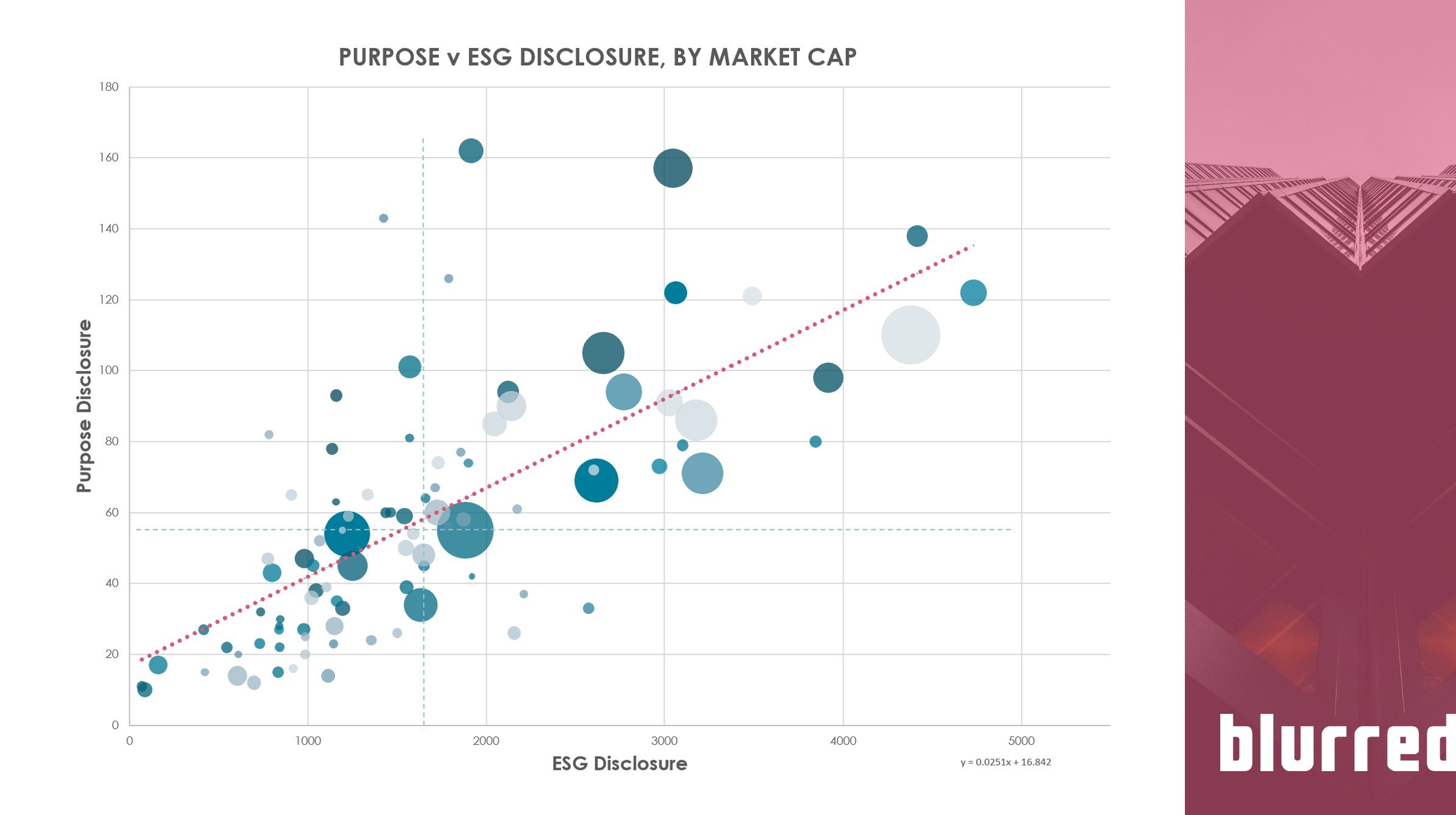

To begin, we analysed the entire FTSE100 dataset, and explored firstly, the relationship between ESG vs Purpose communication within the last financial year. We counted tens of thousands of ESG and Purpose disclosures across 100 companies’ reporting.

Importantly, we use statutory reports as the core data source, because your Annual Report, your ESG Report, your Integrated Report: this is where you are held to account. That is where you disclose what you believe in, your targets, how you’re performing against them, how you are failing as well as succeeding. That is where you demonstrate transparency. Forget PR metrics of ‘trust’ as a reputational goal. It’s here, in published articles of official record, that you earn trustworthiness. This form of communication cannot be altered, as a website can be, to rewrite history. Facts cannot be hidden or glossed over. You cannot easily get away with unsubstantiated claims in the same way a 60 second TV spot might.

They are your truest narrative to the world. And that narrative is an impact narrative.

When we ran the highest level analysis to look for trends, the first thing we found was that there IS a relationship between the volume of published ESG disclosures, and how much companies talk about Purpose. This was a promising starting point.

We noticed that companies are clustered together when volumes of ESG and Purpose communication are low and disperse as numbers of disclosure go up. Most smaller companies (indicated by the size of the bubble) cluster towards the bottom left, while larger market cap companies are investing in putting a huge amount of ESG and Purpose information out there.

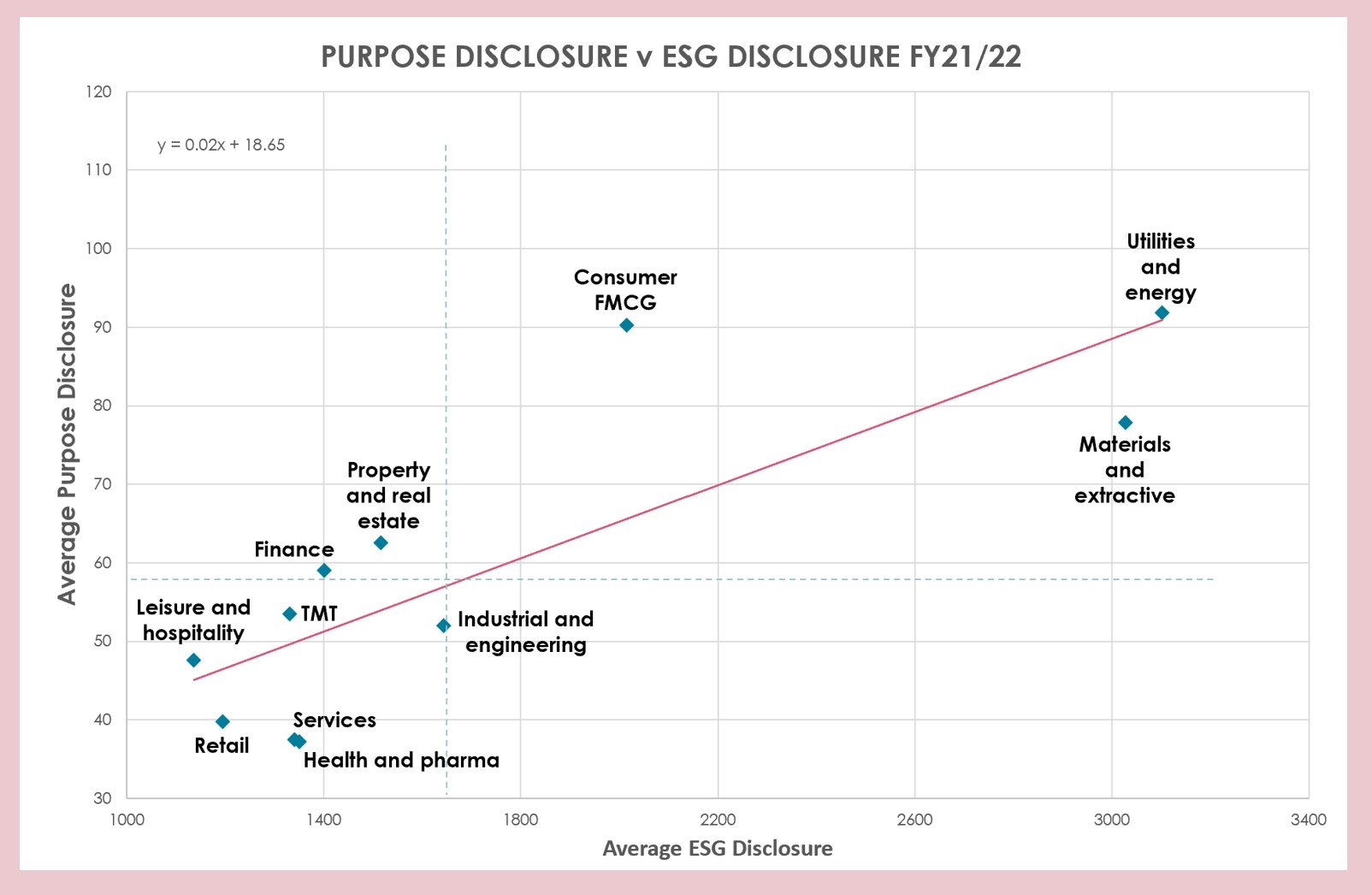

But the sectors that are nominally leading might not be who you’d expect.

This is a bit of a theme.

Industries with significant environmental challenges, like mining and energy, are releasing a lot more information regarding both ESG AND Purpose. That’s not just because those industries are highly regulated – if that were the case you’d expect to see pharma and financial services up there too, but they lag far behind.

It’s also striking that consumer FMCG brands are talking way more about purpose than the natural trend line indicates is the norm. But our overall finding was that few companies in the FTSE100 are meaningfully connecting ESG to P in their highest-level communication.

As just one simple example, less than a quarter of companies reference wellbeing objectives (people, planet, environment, society) in their Purpose statement.

This suggests a more material disconnect between Purpose and ESG, which we found to be true under more detailed examination.

And part of this is because we’re a long way from best practice Purpose…

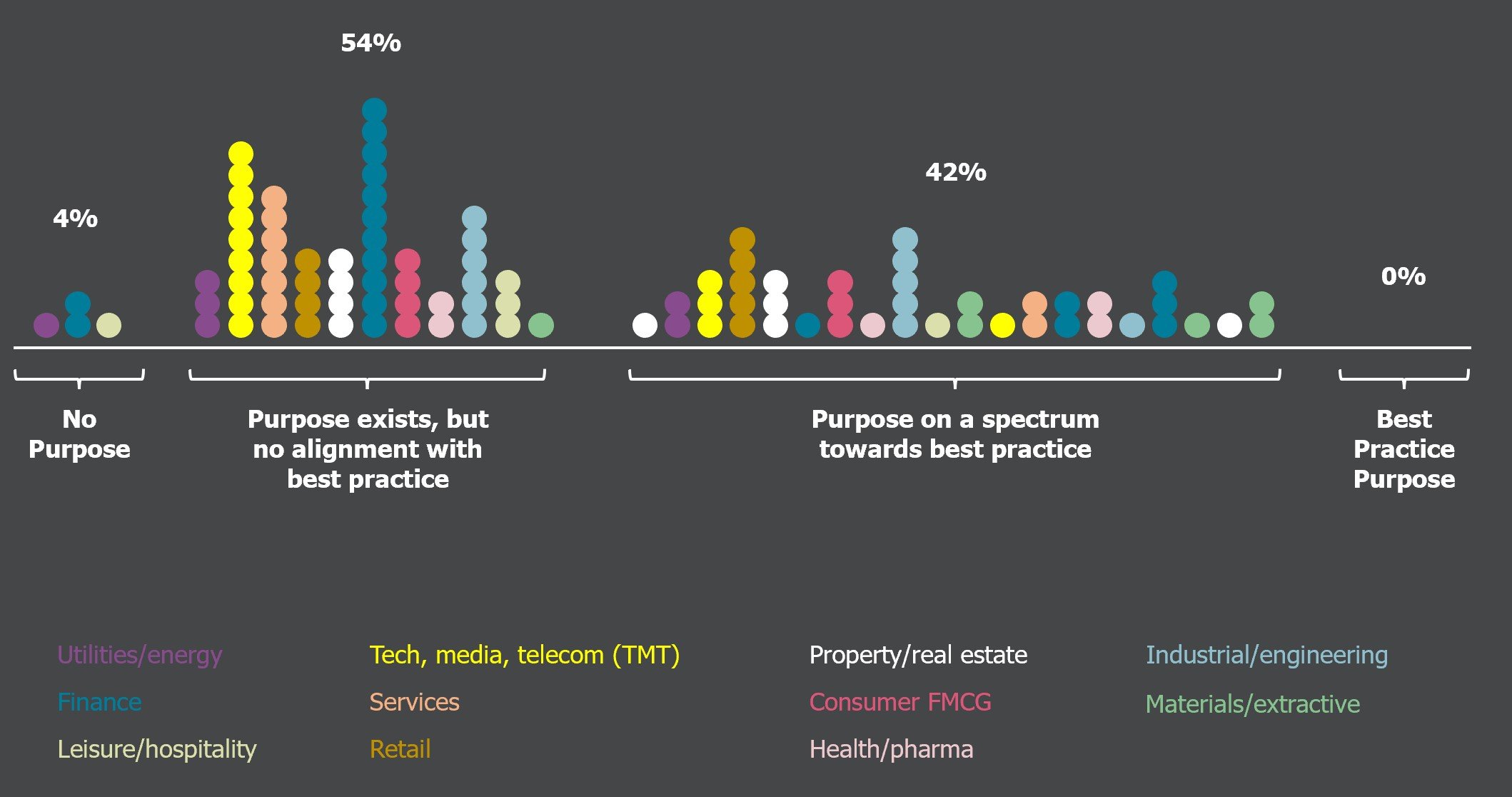

Less than half of FTSE100 companies are demonstrating progress towards best-practice.

One of the first things we did was evaluate every FTSE100 business’s stated Purpose. Each circle here represents a FTSE100 company. This isn’t a deep analysis of the substance and actions behind that Purpose statement. It is an initial overview of the state of play right now.

We’ve placed each company on a spectrum from no purpose at all – remarkably four FTSE100 multinationals still fall into this category, in 2023 – to best practice, which we consider to be full alignment with PAS808. That framework is new so I am not at all surprised to see no companies fully meeting its criteria yet.

What’s more interesting is the cluster of companies on the left: the majority of FTSE100 businesses have a stated Purpose that demonstrates no alignment with best practice whatsoever.

And the nature of those businesses is interesting. Nearly all tech and finance companies fall into this category, as well as the majority of consumer FMCG brands, which may come as a surprise.

43% of companies are on a spectrum towards best practice and again, it’s interesting to note that the companies aligning most closely to best practice Purpose are companies from problematic ESG sectors: in particular mining companies and construction companies.

What we did next was use all this big data to inform the development of our core methodology for evaluating the ESGP Impact Gap. More detail can be found in our inaugural report, but for the purpose of this blog post, let’s take a look at one of the companies we found to be a real leader when it comes to integrating ESG and Purpose in order to maximise positive impact: Prudential.

Prudential treats ESG and Purpose in a deeply integrated way. The company leads with its Purpose in its annual report. It meaningfully connects its Purpose to a societal problem it can help solve: Prudential exists to contribute to the wellbeing of people (particularly in Asia and Africa) who are financially excluded. It’s clear that major business decisions – from relocating to these regions to product development – are guided by this Purpose.

Throughout its reporting, Prudential consistently discusses Purpose and ESG as two inextricable dimensions of its strategy. The Chair, Shriti Vadera, uses an entire section of her introductory statement in the annual report to explicitly connect ESG to Purpose.

The company is explicit that it sees ESG and Purpose as a Board responsibility. It has established a working group to oversee ESG as the foundation for delivering its Purpose. It provides data on how its ESG investments are delivering against its Purpose. It details how executive remuneration is connected to both Purpose and ESG.

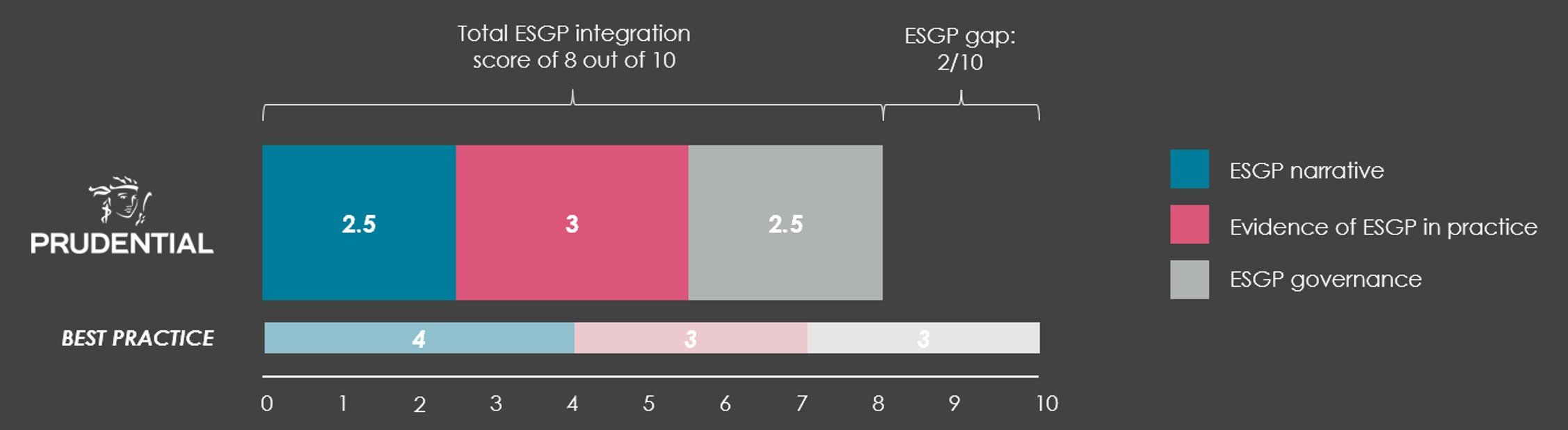

And here I introduce you to our ESGP integration scoring tool itself. For the initial score we focus on three core criteria:

-

CLARITY OF ESGP NARRATIVE

-

ESGP IN PRACTICE

-

ESGP GOVERNANCE

The total score available is 10, which would indicate comprehensive ESGP integration across core narrative, evidenced in values and behaviours, and maintained with clearly communicated governance.

Prudential scores highly – 8 out of 10. Nobody in the FTSE100 has a perfect score. The highest is 9 – incidentally, that is Anglo American, a huge mining company again, not a consumer brand as you might expect.

There is still more Prudential could do, of course. The company could align to the PAS808 framework in order to deepen its ESGP integration in terms of culture. It could be more explicit that people and planet are the ultimate beneficiary stakeholders of its strategy. It could declare a clear rationale for how its Purpose will be used in decision-making.

But among the FTSE100, we consider Prudential to be a clear leader in terms of ESGP integration.

How does your company score? Some big consumer FMCG brands that champion sustainability and Purpose did not score as well as you might expect.

This matters. It matters for the most important reason of all: that all of us have to get this right if we’re to fulfil that responsibility we have to make a difference. But it also matters, practically, because your investors are calling for it.

Here are three things you can action today, in order to begin optimising the business for impact, by integrating ESG and Purpose properly.

Firstly, you can get a read-out on where you are right now. Which naturally we can help with.

What’s your ESGP Impact score? How integrated is your company Purpose with your ESG strategy? Where are the gaps and weaknesses? How is that integration lived within the organisation? Do people and teams understand the principles and why this is important? Is impact the goal for everyone? Is this evidenced in company culture?

The second thing you can do is establish some good processes. Evidence of good governance comprises 30% of the score in Blurred’s Impact Gap methodology. This is about asking:

-

Who owns Purpose? Who is accountable for its delivery?

-

How and where is it disclosed?

-

How are brand campaigns briefed with it in mind?

-

How do you design them to be aligned with Purpose delivery?

-

How do you measure impact?

-

How do you communicate that process internally to start spreading and demonstrating best practice?

And thirdly, you can do this: get your ESGP narrative . It is your licence to talk credibly about positive impact.

If you want to improve your investor comms; if you want to increase employee advocacy; if you want to avoid greenwashing; if you want to drive more ROI on creative campaigns… Get your ESGP narrative right.

Ultimately, if you want to deliver positive impact: Get your ESGP narrative right.

Getting it right – and by right we mean watertight: integrated, credible, effective – is the best starting point. Because that process will act as a forcing function to examine other vital pieces of this jigsaw. To get it watertight, we’ll need to look at whether the substance is there: are you walking the walk on the things you talk a good talk on? We’ll look at governance and processes. We’ll look at how you report. We’ll look at how you disclose your Purpose? Is that Purpose fit for purpose? We’ll assess team structure – who owns what? How are ESG teams and Purpose marketers operationally integrated? Do they communicate with one another? Do they understand each other’s agenda? We’ll look at how creative campaigns are briefed – is the starting point “we want publicity for this initiative?” or is it “We want to create impact and inspire our consumers to help us make a difference”?

So don’t be distracted by phoney culture wars about ESG, don’t misuse Purpose as a strapline, and don’t fall into greenwash traps.

Focus on creating a real business strategy for impact.

Focus on creating the narrative for impact that will catalyse that action.

Build that narrative by integrating ESG and Purpose. Minimising harm and maximising good. Use one to substantiate the other. Make that the manifesto for the company. Get ESG and P working together to deliver it.

Because you have the responsibility and the capability to make a difference.

And that’s exciting.

The full report containing all methodologies used can be downloaded here.