By Kristina Saxelby, Senior Consultant

One of the articles of faith in ESG is that companies that are effective in managing material ESG risks are more resilient than those that are not – and that resilience is an important contributory factor in achieving above-average financial performance over the longer term.

In recent years, capital markets data seemed to prove exactly that. Historically, funds and indices focused on companies with high ESG ratings (“ESG leaders”) generally outperformed the market. Additionally, companies with strong ESG credentials have tended to benefit from lower average cost of capital and debt than “ESG laggards” with poor ESG performance. It’s been a winning combination, linking effective ESG risk management with value creation. Not quite planet, people and profit in perfect alignment (that nirvana still awaits many firms), but at the very least a good step towards it.

But here’s the plot twist. 2022 capital markets data appears to demonstrate that, for the most part, the tables have turned. Collectively, “ESG leaders” have lost hundreds of billions of dollars in value, while companies (and whole sectors) typically excluded from ESG indices significantly outperformed the market.

This is helpful ammunition for the US Republican anti-ESG movement (and their equivalents in other countries) whose proponents argue that ESG strategies are in conflict with company directors’ fiduciary duties to maximise shareholder returns. For those critics, ESG isn’t simply ‘woke’ ideology dressed up as business strategy. Based on the most recent data, it would seem it also destroys value.

“ESG leaders” did, collectively, underperform in 2022. But the question is – why? And, what does that data really tell us about ESG in an investment context?

Let’s break it down.

When we talk about capital markets analysis focused on “ESG leaders”, that term refers to the aggregate performance of a basket of companies across different sectors over a specific time period. What’s involved is an assessment of movements in the total combined value of all those different companies with a high (usually AA or AAA) ESG rating. The same is true, of course, for any kind of fund or index focused on specific sectors or geographies. What’s measured is the aggregate performance achieved collectively by the constituent companies.

If the “ESG leaders” segment you’re tracking includes companies with a total combined value of $4 trillion – and after 12 months their value has risen to $4.4 trillion – well, that’s a 10% increase in value. And if the wider market excluding your “ESG leaders” grew by 5% over the same period, then that’s a 5 percentage point relative outperformance. At which point, all is good and well in the world of ESG investing.

However, the logic also applies in the opposite direction. If the “ESG leaders” drop from $4 trillion to $3 trillion in total combined value while the rest of the market outside the “ESG leaders” segment only lost 10% in value over the same period, then the “ESG leaders” have underperformed the market by 15 percentage points. Not so happy in the ESG world.

Which brings us to the latest market data. “ESG leaders” have historically included a large number of technology and telecoms firms including the Big Tech (so-called “MAMAA”) stocks, as these are relatively ‘clean’ businesses that were also among the first to address climate change risks and decarbonise. And ESG-focused funds and indices generally exclude companies linked to the potential for severe environmental or human rights harms, including much of the extractives sector (especially oil and gas) and the defence sector.

Then 2022 happened. Russia invaded Ukraine just as the world began to emerge from Covid. Energy commodity benchmarks soared to multi-decade highs. Defence and oil and gas sector stocks roared past the rest of the market – sectors that include several mega-cap titans such as Exxon, now at an all-time high.

At the same time, Big Tech stocks plummeted through 2022. There are several different reasons for that, from an investor perception of overexpansion and weak strategic discipline during lockdown to anti-trust concerns and more broadly a sense that the world may be approaching ‘peak tech’ (especially in video streaming platforms, for example). Big Tech companies are also mega-cap titans, so when their stocks fell in the 12 months from January-December 2022 (and in the worst instance by almost 50%), those movements wiped out a big chunk of the total combined value of the “ESG leaders”.

In short, the “ESG leaders” faded in 2022 because Big Tech stocks had a very bad year and because the war in Ukraine warped global commodity markets and triggered a defence strategy reset in many countries. None of which factors has anything to do with the merits or demerits of ESG as a key aspect of good corporate stewardship, value protection – and long-term value creation.

UPDATE: 4 March 2023

There’s an interesting postscript to my post above on the sector-specific factors underlying the relative underperformance of the capital markets “ESG leaders” during 2022.

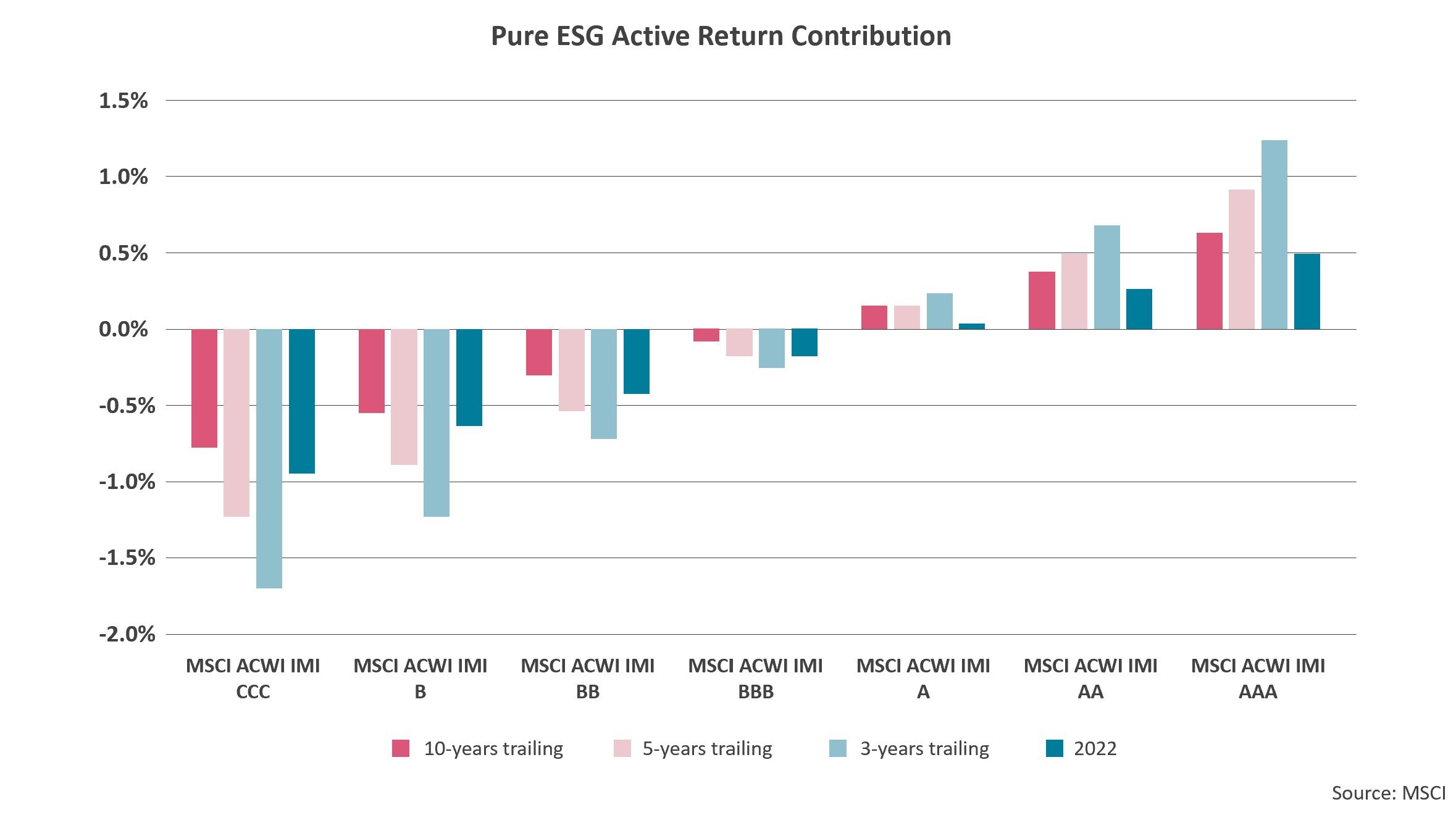

MSCI recently published new research examining long-run returns performance of companies clustered by ESG rating. That research has been adjusted to strip out sector-wide performance and other external macroeconomic factors. In effect, the data is normalised to remove the effects of the Big Tech surge and fallback and the upswing in energy and commodity costs post-Covid and the Russian invasion of Ukraine.

It’s what could be referred to as a ‘pure’ view of the ESG contribution to value creation over the long term. And, as you’ll see from the chart, the underlying point comes through clearly. Good ESG risk management translates into greater longer-term corporate resilience – which translates into stronger financial performance over time.